The tax year is coming to a close. But before the year ends, consider these ten tax strategies that might be able to maximize how much money you can keep from Uncle Sam.

Continue reading “Top 10 End of Year Tax Tips”

The tax year is coming to a close. But before the year ends, consider these ten tax strategies that might be able to maximize how much money you can keep from Uncle Sam.

Continue reading “Top 10 End of Year Tax Tips” →

In this ever-changing electronic age, it’s never been easier to conduct business and take care of finances through a computer or smartphone. But this convenience comes at a cost. It’s also never been easier to steal someone’s identity and use that fake identity to engage in crime. The good news is that most cases of tax-related identity theft can be prevented by following a few simple rules.

Continue reading “How to Prevent Tax-Related Identity Theft” →

Many millions of individuals and businesses have to pay taxes. It’s about as inevitable as well…death and taxes. But how these taxes are paid will depend on several factors. For most taxpayers, taxes will be paid on a regular basis throughout the year, whether it’s from an automatic deduction from a paycheck or by making quarterly payments. But what happens when the taxpayer owes taxes that go beyond these regular payments, such as when there are back taxes owed? There are two common arrangements to choose from.

Continue reading “How to Pay the IRS When You Owe Taxes” →

Unlike other debts, a tax debt is one of the hardest debts to deal with. One reason why tax debts are so debilitating is that the tax collecting entities, such as the Internal Revenue Service (IRS) and the California Franchise Tax Board (FTB), can take money directly from a taxpayer’s paycheck. This is often referred to as a wage garnishment or a wage levy.

Continue reading “How to Stop IRS and California Tax Garnishment?” →

Scams aren’t new, having been around for a long time, with some well-known ones occurring back in the 1800s. But phishing scams are a bit more recent, because they’re based on the use of electronic communication. Because one of the best ways to defeat a confidence scheme (such as phishing), is to be able to recognize it, fraudsters are constantly thinking up new scams to confuse and trick potential victims. But before we go over a new scam, let’s discuss what phishing is.

Continue reading “Phishing Scams and What to Do” →

What Is an Offer in Compromise?

If you’ve found yourself drawing the ire of the IRS due to unpaid tax debts, you might be wondering what your options are. Well, one of the most enticing is the offer in compromise, or OIC. This allows you to potentially satisfy your tax debt for less than what you fully owe. Sounds like a good deal, doesn’t it? It is if you can get it, as the IRS has the right to reject a taxpayer’s OIC.

Continue reading “Offers in Compromise” →

After the tax audit, tax liens and levies are some of the most dreaded actions the IRS can take against a taxpayer. One of the reasons they’re so feared is because they’re not very well understood by most people. Well, we’re going to try and change that by shedding some light on these tax collection tools used by the IRS, including how to avoid becoming subject to them.

Continue reading “Tax Liens and Levies’ Ins and Outs” →

One of the hallmarks of our country is the concept of due process. This refers to following the law when a government takes action against an individual. And if there is ever a time when the government takes action against an individual, it’s when they’re taking the individual’s money.

Continue reading “Appealing an IRS Decision” →

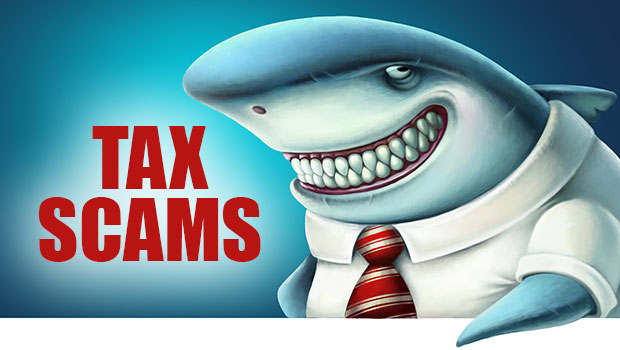

When it comes to scams, they’re almost as inevitable as taxes. The only thing that changes is how the scams work. As taxpayers catch on to existing tax scams, con people look for different ways to trick their victims. Below we identify two of the newer tax scams that many taxpayers may not have seen before.

Continue reading “Current Tax Scams of 2019” →

The threat of an audit is a powerful deterrent and does a good job of motivating taxpayers to pay the IRS what they owe. But sometimes this isn’t enough and taxpayers still forego their legal duty to pay their tax obligation. When this happens, the IRS will reach out to the taxpayer to collect an outstanding tax debt. But when asking nicely doesn’t work, the IRS can impose a tax lien and/or a levy.

Continue reading “Getting Rid of an IRS Lien or Levy” →